President Donald Trump is intensifying pressure on Senate Republicans to back a sweeping tax and immigration package, warning that failure to deliver would constitute a betrayal of the party’s core promises to voters. In a Saturday statement, the White House threw its full support behind the Senate’s version of the legislation, which pairs deep cuts to mandatory spending with expanded border security, defense appropriations, and energy development provisions.

The White House wrote that it would be a “betrayal” for Congress to turn its back on the Trump agenda.

The Administration strongly supports passage of the Senate Amendment to H.R. 1, the One Big Beautiful Bill Act. This bill implements critical aspects of President Trump’s budgetary agenda by delivering bigger paychecks for Americans, driving massive economic growth, unleashing American energy, strengthening border security and national defense, modernizing America’s air traffic control system, preserving key safety net programs for Americans who need them, while ending waste, fraud, and abuse in Federal spending, and much more.

President Trump is ushering in the Golden Age of America. H.R. 1 will build upon the unprecedented economic progress already made under his leadership. This bill will deliver the largest tax cut in American history for middle- and working-class families and small businesses. Not only will the bill make President Trump’s highly successful 2017 tax cuts permanent, but it will advance his key campaign promises—no tax on tips, no tax on overtime, a Made in America Auto tax break, and additional tax cuts for our seniors on Social Security. It will also bring back jobs and bolster American manufacturing by making bonus depreciation permanent and providing full expensing for new factories and factory improvements. In addition, the bill makes permanent and enhances Opportunity Zones to continue the private sector driven revitalization of distressed communities across America.

With its passage, Americans will keep more of their hard-earned money while taking home much bigger paychecks that will unleash economic growth nationwide. The White House Council of Economic Advisers estimates that within the first four years of the bill’s implementation, take-home pay for a family of four will increase by $7,600–$10,900 per year and that 6.9 to 7.2 million jobs will be protected and created. Additionally, the bill will lower costs by unleashing American energy through incentivizing expedited permitting, opening up federal lands for production, and eliminating spending on wasteful environmental policies.

This bill provides funding to protect American sovereignty and advance President Trump’s “Peace Through Strength” agenda. The One Big Beautiful Bill Act delivers the single largest investment in border security in American history, ensuring that President Trump’s widely supported and effective border security measures are made permanent. With this investment, we will stop the deadly flow of fentanyl from flooding into our communities, fully fund the border wall and physical infrastructure, provide hiring and retention bonuses for Immigration and Customs Enforcement (ICE) officers and Border Patrol agents, detain and deport illegal aliens, and enable the Coast Guard to protect our shores. In the face of continued and growing threats from adversaries and competitors across multiple theaters, H.R. 1 is a once-in-a-generation opportunity to rebuild our military with the first ever $1 trillion defense investment.

The One Big Beautiful Bill Act reflects the shared priorities of both the Congress and the Administration. Therefore, the Congress should immediately pass this bill and send it to the President’s desk by July 4, 2025, to show the American people that they are serious about “promises made, promises kept.” President Trump is committed to keeping his promises, and failure to pass this bill would be the ultimate betrayal.

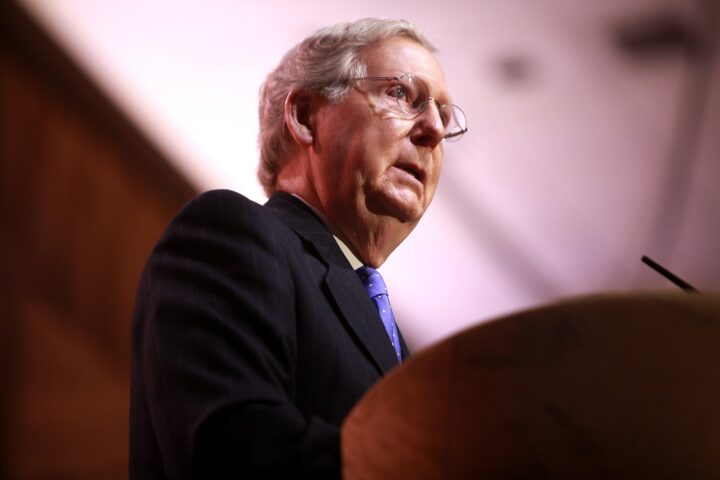

Senate Majority Leader John Thune pressed for a procedural vote on Saturday, but internal GOP divisions threaten to derail momentum. Several Republican senators have voiced concern over the bill’s scope, cost, and the compressed timeline for consideration.

Sen. Ron Johnson, from Wisconsin, a fiscal hawk, announced on Fox & Friends Saturday that he would oppose advancing the measure unless lawmakers are given time to fully analyze its financial implications. “We need to know exactly what’s in it,” Johnson said, noting he had received the bill text only hours earlier and criticizing the rushed process.

Joining Johnson in raising alarms are Senators Mike Lee, from Utah, and Rick Scott, of Florida, both of whom are seeking deeper spending reductions. Sen. Rand Paul, from Kentucky, has gone further, declaring he will vote no if the bill includes a proposed $5 trillion increase in the debt ceiling—a provision still embedded in the Senate draft.

The White House is pitching the legislation as a cornerstone of Trump’s second-term agenda. In addition to broad tax relief, the administration is touting new incentives for domestic energy production and reforms aimed at accelerating permitting on federal lands. But with Democrats united in opposition and Senate Republicans allowed only three defections before the measure collapses, party leadership is facing a high-stakes vote with little margin for error. As closed-door negotiations continue, the outcome remains on a knife’s edge.