President Donald J. Trump reportedly sharply rebuked Federal Reserve Chairman Jerome Powell on Friday morning, escalating his long-running critique of the central bank’s reluctance to lower interest rates amid mounting evidence of a cooling labor market and persistent inflation concerns.

Taking to Truth Social, Trump labeled Powell a “stubborn MORON” and urged the Fed’s board of governors to override his decision to hold rates steady. “Jerome ‘Too Late’ Powell, a stubborn MORON, must substantially lower interest rates, NOW. IF HE CONTINUES TO REFUSE, THE BOARD SHOULD ASSUME CONTROL, AND DO WHAT EVERYONE KNOWS HAS TO BE DONE!” Trump declared.

The frustration follows the Fed’s Wednesday decision to keep interest rates at 4.25% to 4.5%, a move Trump contends is throttling growth at a critical time.

Notably, two members of the Fed’s board — Vice Chair of Supervision Michelle Bowman and Governor Christopher Waller — dissented, marking the first double dissent in over three decades. Both are reportedly under consideration to replace Powell when his term expires next May.

“STRONG DISSENTS ON FED BOARD. IT WILL ONLY GET STRONGER! ‘TOO LATE!’” Trump posted, signaling rising tensions inside the central bank and frustration with Powell’s leadership.

The clash comes as new Labor Department data paints a less-than-rosy picture of the economy. The July jobs report showed the U.S. added just 73,000 jobs — a sharp slowdown — while the unemployment rate held steady at 4.2%. Even more troubling were revisions to May and June’s figures, which wiped out roughly 250,000 previously reported jobs.

Trump, who has long championed aggressive pro-growth policies, warned that Powell’s cautious approach is costing Americans. “Too Little, Too Late. Jerome ‘Too Late’ Powell is a disaster. DROP THE RATE!” Trump wrote. He pointed to one bright spot: “The good news is that Tariffs are bringing Billions of Dollars into the USA!”

The president’s call to action underscores the growing divide between elected leadership and the traditionally insulated central bank.

Powell, who has defended the Fed’s decisions by citing economic uncertainty — some of it stemming from the president’s trade policy — now faces mounting pressure from within his own institution and from the Oval Office.

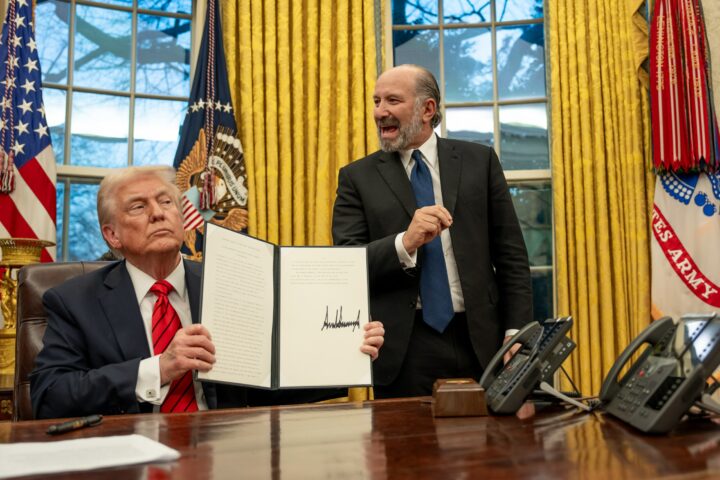

Just last week, Trump visited the Fed for a reportedly cordial meeting with Powell to view ongoing renovations, signaling a possible détente.

But that thaw has apparently melted in the wake of dismal economic indicators and what many within conservative circles view as Powell’s persistently timid stewardship of monetary policy.

As the 2024 campaign heats up, the Fed’s independence — and Powell’s future — may once again become a focal point in the battle over how best to revive American economic dynamism.

[READ MORE: Trump Unveils Ambitious White House Renovation Plan: ‘A Gift to the Country’]