On Thursday, the Supreme Court reportedly upheld a tax on foreign income that helped finance President Donald J. Trump’s 2017 tax cuts, in a case that many experts said may undermine the country’s tax system.

The vote was 7-2, with Justice Brett M. Kavanaugh writing the majority decision.

He was accompanied by Chief Justice John G. Roberts Jr. and the court’s three liberals.

Justice Amy Coney Barrett concurred with Justice Samuel A. Alito Jr., while Justice Clarence Thomas and Justice Neil M. Gorsuch dissented.

The matter before the judges was narrow at first glance: Is the tax in question permissible under the Constitution, which grants Congress limited taxing authority?

In the majority judgment, Justice Kavanaugh wrote that the tax was within Congress’ constitutional jurisdiction.

Many tax experts have cautioned that repealing the levy might have serious consequences.

Such a move may have threatened to radically alter how income is defined, stymie efforts to tax billionaires’ riches, and hinder enforcement of a wide range of other taxes that generate billions of dollars in revenue for the government.

Paul Ryan, the Republican and former House speaker who assisted in the legislation’s drafting, was among those who defended it. Mr. Ryan warned that repealing the tax might jeopardize up to a third of the United States’ tax code.

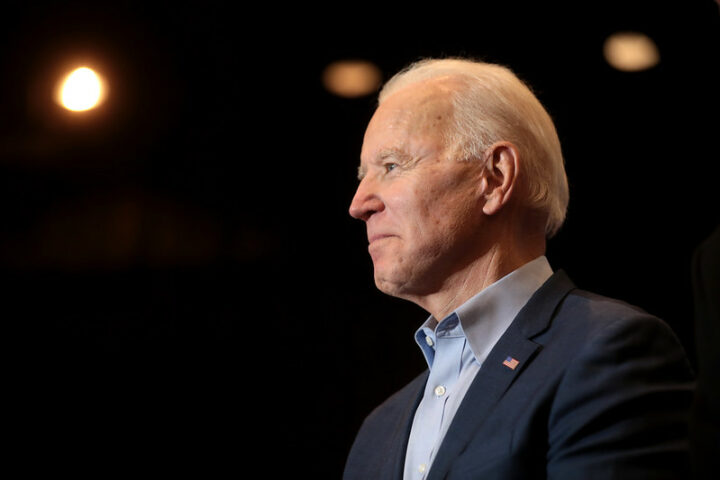

He joined the Biden administration and some other conservatives in their effort to keep the statute intact.

The issue concerned a Washington State couple, Charles and Kathleen Moore, who challenged the statute after being obliged to pay over $15,000 in taxes as a result of their investment in an Indian company that supplies rural farmers.

The Moores’ investment fell under an otherwise obscure clause of the Tax Cuts and Jobs Act of 2017, which changed how the federal government taxes business profits generated abroad.

The provision requires U.S. shareholders who possess 10% or more of foreign firms largely owned or controlled by Americans to pay a one-time tax.

Previously, they only paid taxes on profits brought into the United States.

The argument is whether the Moores should be taxed notwithstanding the fact that they earned no revenue from the investment.

[READ MORE: Putin Signs Major New Defense Pact With North Korea]