Chairman of the Senate Energy Committee Joe Manchin (D-West Virginia) condemned as contrary to the text of the landmark climate legislation the Biden administration’s new guidance on “foreign entities of concern” (FEOCs) that are ineligible for electric vehicle (EV) tax credits under the Inflation Reduction Act (IRA).

Manchin further contended that the administration was actively pursuing “workarounds” to circumvent the restrictions imposed by the IRA on Chinese battery components.

“The proposed Treasury rules on Foreign Entities of Concern are another example of the Biden administration clearly breaking the law to try to implement a bill that it could not pass. The Inflation Reduction Act clearly states that consumer vehicles are ineligible for tax credits if ‘any of the applicable critical minerals contained in the battery’ come from China or other foreign adversaries after 2024. But this administration is, yet again, trying to find workarounds and delays that leave the door wide open for China to benefit off the backs of American taxpayers.” Manchin announced in a statement.

The guidelines published on Friday delineate criteria that determine whether a company qualifies as a FEOC. Notably, connections to countries such as North Korea, China, Iran, and Russia are deemed ineligible.

Particularly objectionable were provisions that grant exceptions for specific trace critical minerals, which, according to the Treasury Department, constitute less than 2 percent of the critical minerals utilized in batteries.

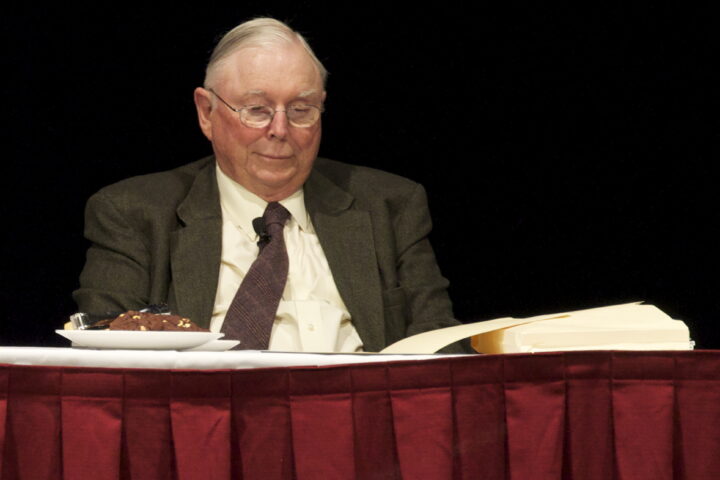

In 2022, Manchin emerged as a pivotal figure in the advancement of the IRA subsequent to his withdrawal of support for the more ambitious Build Back Better Act.

Subsequently, he has developed an intense disapproval of its execution, specifically concerning electric vehicles, and has levied allegations against the Biden administration that it places an emphasis on renewable energy sources at the expense of energy security provisions.

[READ MORE: House Democrat’s House Vandalized by Pro-Palestine Activists]