On Friday, the White House reportedly requested that lawmakers raise the penalty for senior bank executives who rule over the failure of their respective companies.

The failure of Silicon Valley Bank, one of the greatest financial institutions in the United States, occurred a week ago as a result of a rush by depositors to withdraw their money after the business sustained significant losses as a result of the liquidation of a long-term bond portfolio.

The Federal Deposit Insurance Corporation is now in charge of managing the holdings that were kept by Silicon Valley Bank, which was shut down by the state regulators of California on March 10th, as well as those kept by Signature Bank in New York, which was also shut down on Sunday.

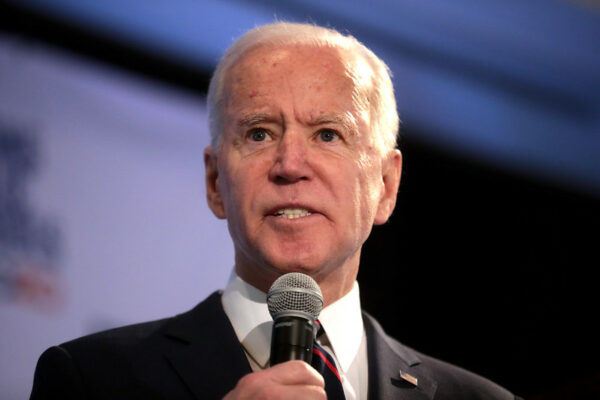

The administration of President Joe Biden said that members of Congress ought to expand the federal government’s jurisdiction in order to “hold top management responsible when their banks collapse” or fall under the supervision of the FDIC.

Officials from the White House stated that the government-backed corporation ought to have additional powers to seize executive compensation and benefits.

They made this statement after noting that the former CEO of Silicon Valley Bank, Greg Becker, sold more than $3 million in shares in the days leading up to the bank’s failure.

The existing barrier of $250,000 is appropriate for the majority of individuals, but corporations, such as those that are supported by Silicon Valley Bank, sometimes hold onto bigger funds so that they can pay personnel and continue operations.

A number of members of Congress, including Representative Maxine Waters (D-California) and Senator Elizabeth Warren (D-Massachusetts), have advocated for Congress to reevaluate the $250,000 barrier.

Warren also introduced legislation that would repeal portions of the Economic Growth, Regulatory Relief, and Consumer Protection Act, which was signed by the former President Donald Trump to lessen the oversight for banks that had between $50 billion and $250 billion in assets.

Warren’s legislation would have the effect of repealing those portions of the act.

[READ MORE: International Criminal Court Issues Arrest Warrant For Vladimir Putin Over Alleged War Crimes]