It may prove to be the most important decision of his presidency. President Donald Trump will begin a pivotal round of interviews this week with finalists to lead the Federal Reserve, opening a new chapter in a months-long effort to select the central bank’s next chair amid intensifying political and economic concerns have gripped the nation over the past few years.

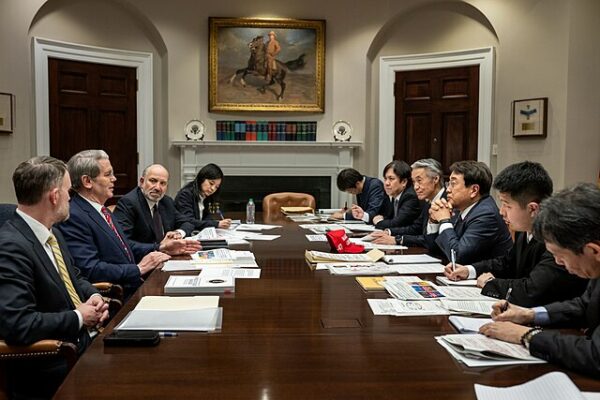

The renewed push follows several weeks of delay caused by scheduling complications inside the administration, according to CNBC. Trump and Treasury Secretary Scott Bessent are expected to meet individually with each contender, starting Wednesday with former Fed Governor Kevin Warsh. Additional sessions with National Economic Council Director Kevin Hassett and other remaining candidates will occur over the coming days, according to people familiar with the planning.

The pause in the process last week briefly raised speculation that the search had stalled or shifted. But Trump rebuffed that notion during a brief exchange with reporters aboard Air Force One Tuesday evening, signaling that his deliberations are well advanced. “We’re going to be looking at a couple different people, but I have a pretty good idea of who I want,” he said.

The stakes are unusually high. Jerome Powell’s term expires in May, and Trump has repeatedly argued that the Federal Reserve should chart a more aggressive course on lowering borrowing costs. His decision comes at a moment when bond markets remain unsettled, inflation expectations are closely watched, and political pressure surrounding monetary policy has reached levels unseen since the Reagan era.

For months, betting markets have treated Hassett as the presumed favorite, reflecting his proximity to the White House and history as one of Trump’s most committed economic advisers. But that assumption has unnerved many institutional investors, especially bond traders, who worry that Hassett might carry the administration’s preferences too directly into the Federal Reserve’s decisions and keep rates “too low for too long” if inflationary risks return. The administration has privately dismissed those concerns as overwrought, though policy insiders acknowledge that Trump values alignment on strategy more than institutional distance.

Whether the latest meetings mark a pivot or simply the end of a carefully staged vetting process is not yet clear. Trump reportedly narrowed his short list in October, leaving a small group now entering final interviews. Along with Warsh and Hassett, the finalists include sitting Fed Governors Christopher Waller and Michelle Bowman, as well as Rick Rieder, a widely respected bond manager who oversees fixed-income strategy at BlackRock.

The timing is notable. The Federal Open Market Committee is expected to approve a third rate cut of 2025 on Wednesday, while Powell is likely to warn against expecting further aggressive easing. Earlier projections from September pointed to just one additional reduction in the coming year, a pace that would disappoint a White House that wants faster relief for consumers and businesses.

That divergence underscores the philosophical friction underlying Trump’s search. He wants a central bank more responsive to shifting economic conditions and more supportive of credit expansion, a position he has articulated repeatedly in recent weeks. In an interview with Politico published Tuesday, Trump made clear he intends to test each finalist on their willingness to pursue steeper reductions if warranted.

As the interviews unfold, Wall Street will read every signal closely, acutely aware that the composition of the Federal Reserve Board can shift the balance of monetary strategy for years. Investors and policymakers alike now await the outcome of a final round that may define the trajectory of interest rates, inflation expectations, and executive influence over America’s most powerful economic institution.