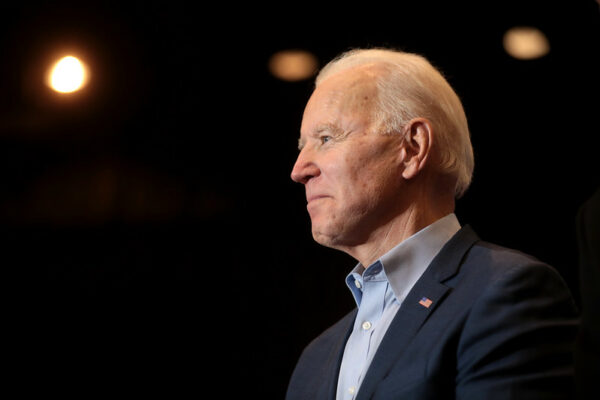

On Friday, the Biden administration put forth stringent regulations for a crucial climate subsidy, aligning itself with environmental organizations despite apprehensions from several major energy corporations that excessive restrictions might stifle an essential sector.

Beneficiaries of extensive tax credits for producing hydrogen, one of the few viable alternatives to fossil fuels in heavy industries such as steelmaking and shipping where renewable electricity and batteries are inadequate, would be determined by the proposed criteria.

It had been cautioned by corporations such as NextEra Energy, BP, and Constellation Energy that stringent regulations pertaining to the tax credit might result in the termination of projects and impede the growth of the emerging sector.

The regulations that were put forth on Friday specify the manner in which businesses that wish to claim the tax credit must acquire the electricity required to produce hydrogen.

Some businesses, academics, and environmental organizations have stated that laxer regulations on these purchases would increase emissions.

Additionally, Air Products and Chemicals and other corporations advocated for stricter standards. AES and Air Products intend to develop new wind and solar energy sources in order to produce hydrogen as part of a $4 billion Texas initiative that would satisfy the requirements proposed on Friday.

The highly anticipated regulations have been among the most disputed since their enactment last year under the Inflation Reduction Act.

The tax credit is substantial, potentially offsetting over 50% of the expenses associated with a conventional green hydrogen project.

It will also usher in a new industry, since the production of pure hydrogen is presently uneconomical without government subsidies.

Prior to Friday’s announcement, corporations and environmental organizations engaged in a months-long lobbying and advertising campaign in an effort to influence administration officials.

The crux of the dispute is whether, in order to qualify for the tax credit, companies that intend to produce hydrogen using fossil-fuel power from electricity systems would be required to purchase equivalent renewable energy on an hourly basis or under a laxer annual standard.

The requirement and provision that new power facilities be utilized for hydrogen production, according to businesses, will impede development and restrict the locations of potential projects.

Furthermore, the maximum subsidy would not be granted to projects that produce hydrogen using existing nuclear power facilities.

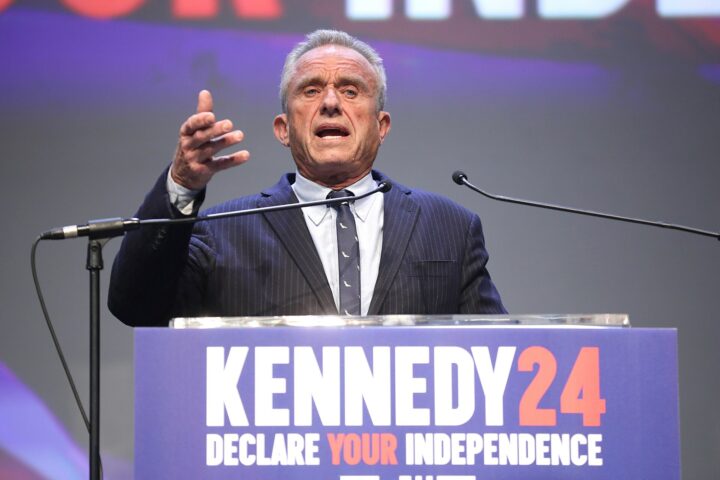

[READ MORE: Supreme Court Declines to Weigh in On Trump Immunity]